GIVING & PLEDGING

"Each of you must give as you have made up your mind, not regretfully or under compulsion, for God loves a cheerful giver."

- 2 Corinthians 9:7

St. George’s is funded primarily through financial contributions from its members.

Those contributions allow us to fulfill our Baptismal vows to promote God’s Word and to offer support and care for our parish family and for our greater community.

PLEDGING

What is a pledge and why is it needed?

A pledge is a financial commitment you make to St. George’s. It strengthens the importance of God and St. George’s in your life. Pledges support a lot of what we do at St. George’s including our worship services, music, staff salaries and benefits, building maintenance, outreach and parish events.

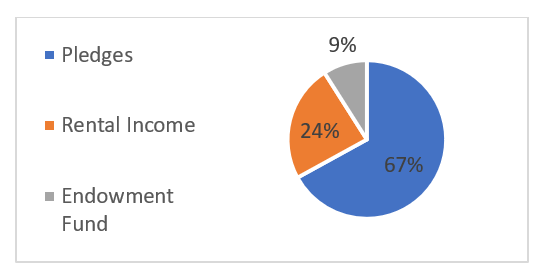

Pledges make up the largest portion of our operating budget:

How much should I give?

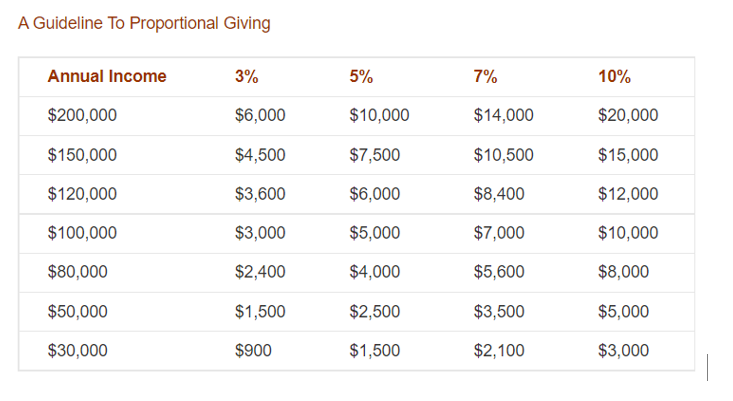

We ask that you prayerfully consider what you feel is the right amount for you. It's different for each person. A tithe (or 10% of your income) has historically been held as the benchmark for giving. However, today people may give to more than one organization. Every pledge makes a difference and is greatly appreciated. The following guideline to proportional giving is a good place to start.

What if I can’t fulfill my pledge?

Financial circumstances can change. A loss of a job or a family member can make a big impact on your annual income. If you find yourself in financial difficulty, simply notify the church office to change your pledge amount.

How do I pledge?

In the fall of each year, a pledge card is sent to each member/family unit at St. George’s. If you are new to St. George’s or haven’t pledged in the past, but wish to do so now, contact the church office to have a pledge card sent to you. Pledges can be made on a weekly, monthly, quarterly or annual basis.

Pledges can be put in the collection plate on Sunday mornings. If you wish to have your pledge automatically drafted from your checking account, please contact the church office for an EFT form.

GIVING - Other ways to give

IRA (Individual Retirement Account)

If you’re over 72 ½, you may meet your required minimum distribution (RMD) requirements and donate from your IRA without increasing your taxable income. Contact your IRA administrator about making a “qualified charitable deduction” (QCD) from your IRA.

Endowment Fund

St. George’s Endowment Fund was established in 1994 to promote the giving of gifts, bequests, and memorials. Endowment Fund income from dividends, interest, capital gains and occasional use of principle is used to support the needs, programs, and activities at St. George’s Church. Contributing to the Endowment Fund is a great way to support St. George’s Church.

You can make a contribution by placing your check in the Sunday offering plate or by mailing it to the church office. You can also consider making a gift to St. George’s Episcopal Church Endowment Fund in your Will. By doing so, you can help create long-term financial stability for our church.

Please contact the church office at (952) 926-1646 for additional information.

The Angel List

St. George’s church has an older building. There are many areas and items that need or will need to be repaired, replaced, or improved at some point. Some of these items can be costly capital expenses that are not appropriate to include in our annual operating budget.

The Angel List was created to raise funds for these capital expense projects. Examples might include replacing a door, improving our handicap access, or removing and replacing a tree damaged by storm.

Please contact the church office at (952) 926-1646 for additional information.